omaha nebraska vehicle sales tax

North Branch - 4606 N 56 St Suite. The Nebraska state sales and use tax rate is 55 055.

Hundreds Of Used Cars For Sale Omaha Nebraska Low Payments High Quality

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

. Ad Lookup Sales Tax Rates For Free. The nebraska sales tax rate is currently. The 7 sales tax rate in Omaha consists of 55.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and. This is the total of state. 05 lower than the maximum sales tax in NE.

Interactive Tax Map Unlimited Use. Omaha NE Sales Tax Rate The current total local sales tax rate in Omaha NE is. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

55 is the smallest possible tax rate. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax.

Taxes And Spending In Nebraska

How The Nebraska Wheel Tax Works Woodhouse Nissan

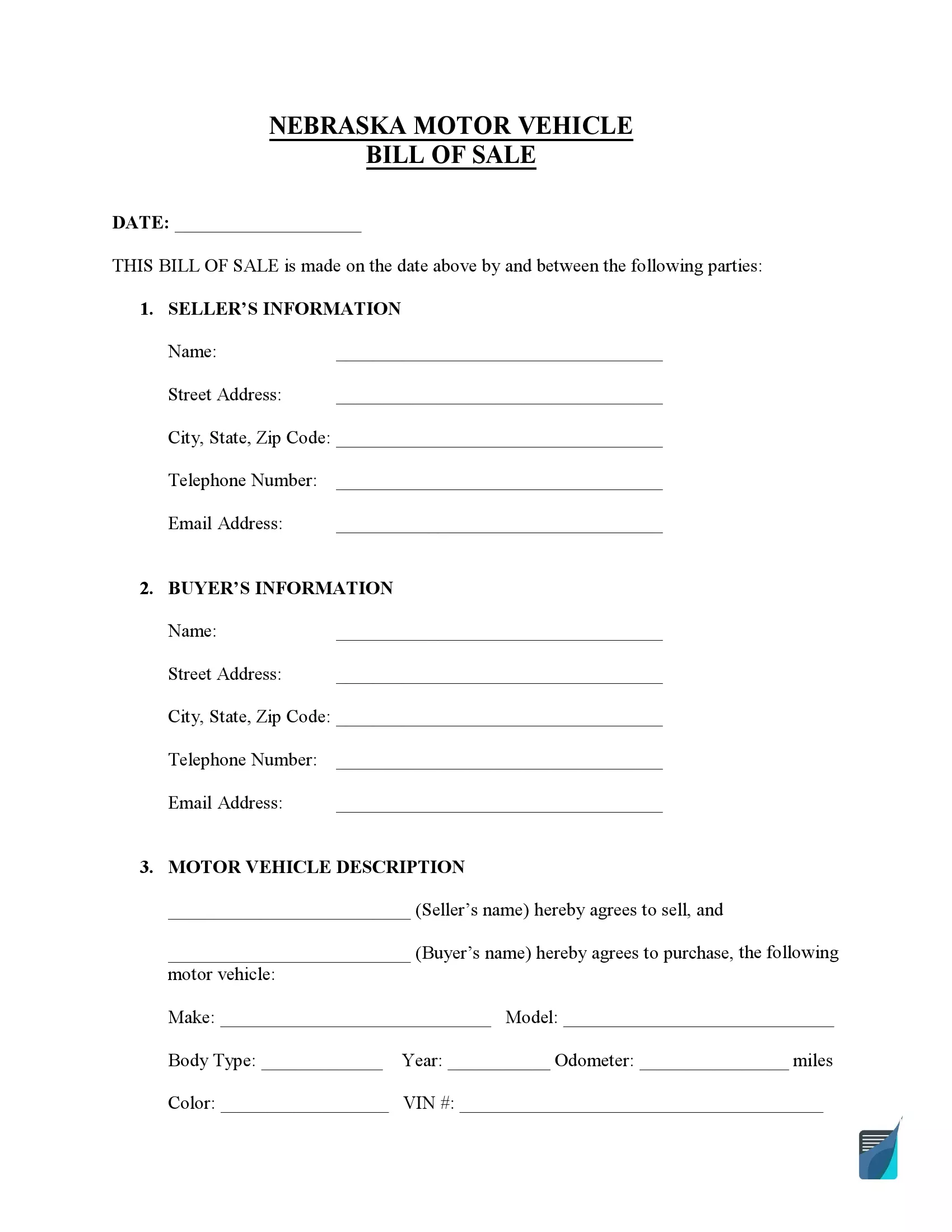

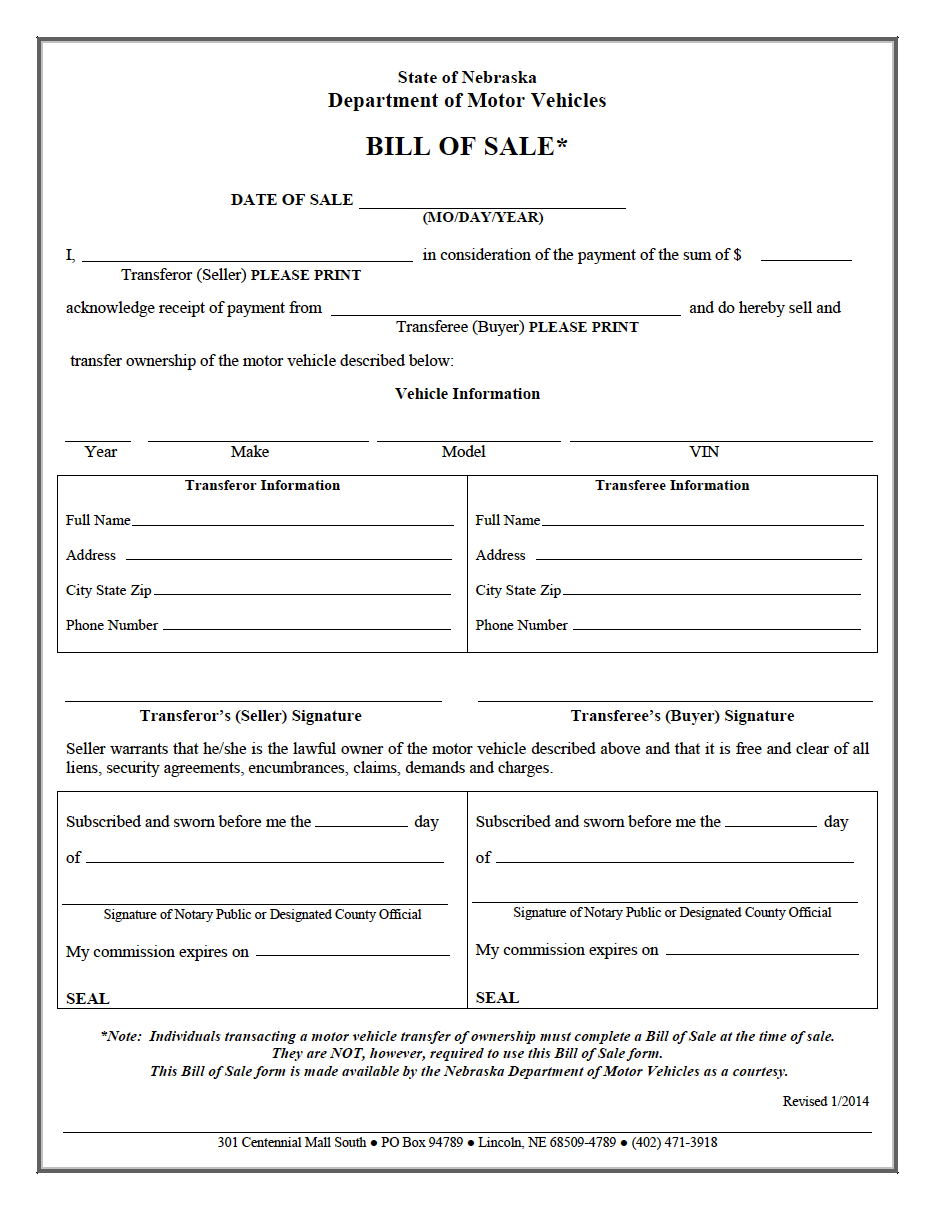

Free Nebraska Bill Of Sale Forms Formspal

Learn More About Ev Tax Credits In Nebraska Woodhouse Auto Family

Best Volkswagen Golf Gti Deals Near Omaha Ne In November 2022 Cargurus

Used Cars For Sale In Omaha Ne Cargurus

Auto Transmission Omaha Ne Des Moines Ia Kosiski Auto Parts

Nebraska State Tax Things To Know Credit Karma

Nebraska Vehicle Registration Laws Com

Nebraska Sales Tax Guide For Businesses

/cloudfront-us-east-1.images.arcpublishing.com/gray/27LYAQ243FFAHMRDXWUVRORVBQ.jpg)

Downtown Omaha Plan Adds Streetcar Puts Mutual Of Omaha Into Current Library Space

New Hyundai Tucson For Sale Near Omaha Nebraska Vern Eide Hyundai Sioux City

Vintage H H Chevrolet Car Dealership Emblem Omaha Nebraska Logo Advertising Ebay

Free Nebraska Bill Of Sale Forms 5 Pdf

Buy A Used Car Near Omaha Ne Pre Owned Vehicles For Sale

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Eforms

Nebraska Title Transfer Etags Vehicle Registration Title Services Driven By Technology

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012